As promised here is one of the stock screeners that I have created. What I have done to make it easier to test and debug is to create a new indicator first. Below are the steps to create an indicator using proRealTime. I have assumed you have logged in and have pro real time up and running.

Step one:

Load any chart and click the indicator/Backtest button.

Step two:

Click the new indicator button

Step Three:

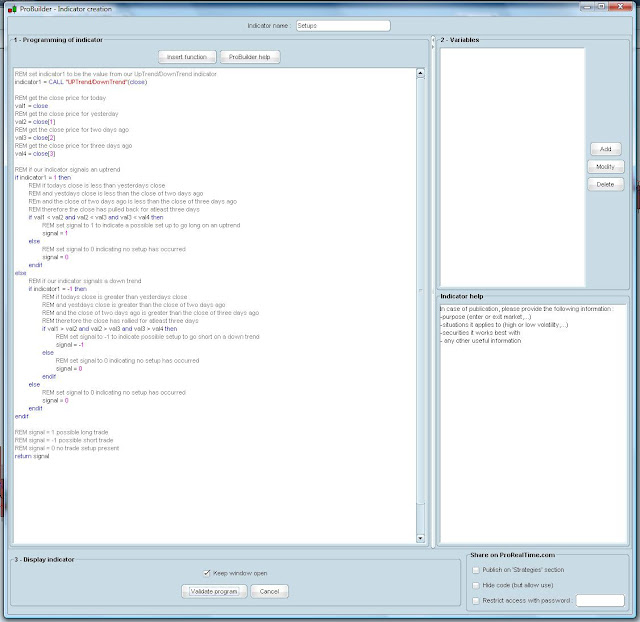

Once the Indicator creation form has loaded

You can then copy and paste the code below into the "Progrmming of inciator" box as above.

You do not need the top and bottom lines below with the code starts here & code ends here in them.You need to copy all the code that is between these two lines and paste it in.

All the lines that start REM are comments that I have added. The will be coloured grey in the proRealTime form. Read through these as they explain what each line of code does.

------------CODE STARTS HERE---------------REMOVE THIS LINE--------------------------

REM get ADX & Directional values for a 14 period

ADXValue = ADX[14]

DIMinusValue = DIminus[14]

DIplusValue = DIPlus[14]

REM get the simple moving averages for the 20, 50 & 200 period

MA1 = average[20](close)

MA2 = average[50](close)

MA3 = average[200](close)

REM if the ADX value is greater than 25 then the stock is trending

REM I have used 25 rather than 30. This way I can possibly catch the trend earlier.

REM It's a little more risky but I think it's worh it

if ADXValue >= 25 then

REM if the DI- is greater than the DI+ then its a down trend so set ADXtrenddriection to -1

if DIMinusValue > DIPlusValue then

ADXtrendDirection = -1

else

REM if the DI+ is gretare than the DI- then its and uptrend so set ADXtrendDIrection to 1

if DIPlusValue > DIMinusVAlue then

ADXtrendDirection = 1

else

REM if DI+ = DI- (rare but could happen) then no trend is in place so set ADXTrendDirection to 0

ADXtrendDirection = 0

endif

endif

else

REM if the ADX value is less than 25 then no trend is in place

ADXtrendDirection = 0

endif

REM if 200MA greater than 50MA & 50MA greater than 20MA then we can assume there is a down trend in action

REM NB this is not stricktly correct as the MA should also be decreasing. This could possibly be added as an extra check here

REM but will have to wait until another time for now

if MA3 > MA2 and MA2 > MA1 then

REM down trend so set MAtrendDirection to -1

MAtrendDirection = -1

else

REM if 20MA greater than 50MA & 50MA greater than 200MA then we can assume there is a up trend in action

if MA1 > MA2 And MA2 > MA3 then

REM up trend so set MAtrend direction to 1

MAtrendDirection = 1

else

REM no trend in place soe set MATrendDirection to 0

MAtrendDirection = 0

endif

endif

REM if the MA indicate an uptrend or the ADX indicates an uptrend then then set the trend direction to 1

REM NB this could be changed to require both of these to be true to qualify for an uptrend. It really just depends on your preference

if MAtrendDirection = 1 or ADXtrendDirection = 1 then

trendDirection = 1

else

REM is the MA indicate a down trend or the ADX indicates a down trend then set the trend direction to -1

if MAtrendDirection = -1 or MAtrendDirection = -1 then

trendDirection = -1

else

REM if no up or down trend the set the trend direction to 0

trendDirection = 0

endif

endif

REM return the trend direction

REM -1 = down trend

REM 1 = up trend

REM 0 = no trend

return trendDirection

------------CODE ENDS HERE---------------REMOVE THIS LINE--------------------------

Step 4:

You need to give your new indiactor a name, I've just called mine upTrend/DownTrend and then click the validate program button.

If it has all worked correctly you should see your indicator added to your chart.

You should also see the following form after creating the indicator. You can just click the close button as nothing needs to be changed.

If you take a look at the indicator on your chart you should see it indicating the uptrends and down trends of the price action. Reminder: 1 = uptrend, 0 = no trend and -1 = down trend

So we now have an indicator which shows if a stock is trending or not.

Now we need to write another indicator to find our potential setups for the day.

So repeat steps one and two above to create a new indicator.

I have called this next indicator Setups

The code for the indicator is below

------------CODE STARTS HERE---------------REMOVE THIS LINE--------------------------

REM set indicator1 to be the value from our UpTrend/DownTrend indicator

indicator1 = CALL "UPTrend/DownTrend"(close)

REM get the close price for today

val1 = close

REM get the close price for yesterday

val2 = close[1]

REM get the close price for two days ago

val3 = close[2]

REM get the close price for three days ago

val4 = close[3]

REM if our indicator signals an uptrend

if indicator1 = 1 then

REM if todays close is less than yesterdays close

REM and yestdays close is less than the close of two days ago

REm and the close of two days ago is less than the close of three days ago

REM therefore the close has pulled back for atleast three days

if val1 < val2 and val2 < val3 and val3 < val4 then

REM set signal to 1 to indicate a possible set up to go long on an uptrend

signal = 1

else

REM set signal to 0 indicating no setup has occurred

signal = 0

endif

else

REM if our indicator signals a down trend

if indicator1 = -1 then

REM if todays close is greater than yesterdays close

REM and yestdays close is greater than the close of two days ago

REM and the close of two days ago is greater than the close of three days ago

REM therefore the close has rallied for atleast three days

if val1 > val2 and val2 > val3 and val3 > val4 then

REM set signal to -1 to indicate possible setup to go short on a down trend

signal = -1

else

REM set signal to 0 indicating no setup has occurred

signal = 0

endif

else

REM set signal to 0 indicating no setup has occurred

signal = 0

endif

endif

REM signal = 1 possible long trade

REM signal = -1 possible short trade

REM signal = 0 no trade setup present

return signal

------------CODE ENDS HERE---------------REMOVE THIS LINE--------------------------

Finish creating the indicator as before.

So now we have two new indicators. They will probably both be displayed on your chart. You can leave them on there for now but once we have created our screener you can remove them from the chart.

So next we create our screener.

Step one:

Load the proScreener list

Once the list has loaded click the set ProScreener button

Then click the New ProScreener button

Once the form has loaded copy and paste the code below into the code box.

------------CODE STARTS HERE---------------REMOVE THIS LINE--------------------------

indicator1 = CALL Setups

c1 = (indicator1 = -1.0)

SCREENER[c1] ((close/DClose(1)-1)*100 AS "% Chg yesterday")

------------CODE ENDS HERE---------------REMOVE THIS LINE--------------------------

One thing to note here is where I have CALL setups in the code this will need to be set to what ever you call your screener.

The code above is for spotting potential setups for a down trend. The code for finding potential up trend setups is below.

------------CODE STARTS HERE---------------REMOVE THIS LINE--------------------------

indicator1 = CALL Setups

c1 = (indicator1 = 1.0)

SCREENER[c1] ((close/DClose(1)-1)*100 AS "% Chg yesterday")

------------CODE ENDS HERE---------------REMOVE THIS LINE--------------------------

In the Selection of list section on the right hand side you need to select which list you want to run your screener on. I always select the uk 300 but theres no reason you couldn't use it for any of the others.

So I think that's about everything. Once you have pasted the code into the screener click validate program and it should find any potential setups for that day.

Once you have done all this I would reccomend you click save so you don't lose all your hard work if proRealTime crashes on you.

If you have any problems with these just let me know and I'll do my best to help you with them.

Obviously the values for ADX & MA are not set in stone and feel free to change and experiment with them. If you do make changes and find you are having some success with them then please let me know and I will add a note here to indicate some other values that people can try.

Don't take my posting here as a trade recommendation. The information contained within this blog is for educational purposes only and should not be taken as advice of any kind. The author of this blog will not accept any responsibily for any loss made by anyone acting or refraining to act as a result of reading material contained within this blog.